Small business set-asides are a portion of federal procurement dollars reserved exclusively for certified small businesses. Large contracting companies are ineligible to bid on these contracts which helps to give smaller organizations a fair chance at securing government contracts.

The foundation for these set-asides was laid with the Small Business Act of 1953, which created the Small Business Administration (SBA) to support and protect small businesses. Over the years, various programs have been introduced to address specific needs and promote diversity, and economic growth within the small business sector.

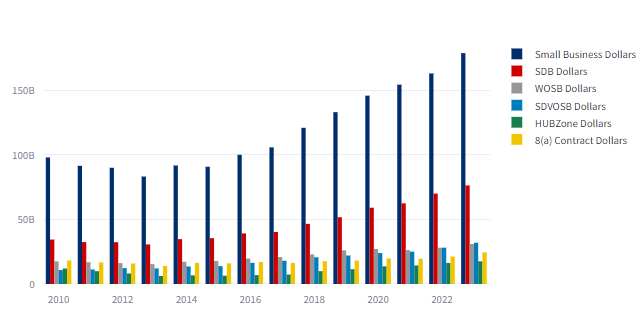

As you can see from the SBA Scorecard graph below, the number of dollars awarded to small businesses continues to increase steadily year-over-year. This means a growing pool of resources available for small businesses just like yours!

What are small business set-aside contracts?

The United States government established small business set-aside contracts to help “level the playing field” for small businesses. This system effectively eliminates competition from the more established top government contractors such as Lockheed Martin and Boenig. Furthermore, every federal government purchase between $10,000 and $250,000 is automatically reserved for small businesses, as long as there are at least two companies that can provide the product or service at a reasonable price.

There are two types of set-aside contracts:

- Competitive set-aside contracts are for when the government decides that there are at least two small businesses that are capable of performing the job. This type of set-aside encourages multiple small businesses to bid, ensuring that the government gets the best value while fostering a competitive environment among small enterprises.

- Sole-source set-aside contracts are used in certain situations where a contract can be awarded to a single small business without a competitive bidding process. These are more common in set-aside categories such as Women-Owned Small Business (WOSB) Program, and Service-Disabled Veteran-Owned Small Business (SDVOSB) Program.

Small business set-aside requirements to know

To qualify for these types of government contracts specifically for small businesses, there are certain requirements you must meet.

- Size: To qualify for small business set-asides you, of course, must be a small business. These size standards are set by the Small Business Administration (SBA).

- Certification: You will also need to be certified by the SBA as a small business and registered in the System for Award Management (SAM) to receive small business government contracts.

- Eligibility: Finally, you will want to look into requirements for specific small business set-aside programs (like HubZone and 8a) to see if you are eligible for additional contract opportunities.

Types of small business set-aside programs

Within the small business set-aside program, there are a handful of subcategories aimed at specific groups:

- 8a set-aside: A broader program for businesses owned and controlled by individuals who are economically and socially disadvantaged.

- HubZone set-aside: An initiative for small businesses located in urban and rural areas with high unemployment or low median income.

- Service-disabled veteran-owned (SDVOSB) set aside: These assist businesses at least 51% owned and controlled by service-disabled veterans.

- Women-owned small business set-aside: Designated for businesses at least 51% owned and controlled by women.

Win more government contracts for your small business!

Despite the challenges that come with government contracting, the potential growth opportunity is far too large to ignore. That’s why understanding the types of small business set-asides available and knowing how to get certified effectively are such crucial steps.

We know just how the government contracting process can, at times, be complicated and frustrating. So at FAMR, we’re here to make it easy for you. Our years of experience working with federal contractors and small businesses means that you’ll have an expert team in your corner to make sure you maximize your contracting opportunities and profit.

Connect with us online today or give us a call to take the first step towards getting your fair share of small business set-asides.